Arizona State Tax Withholding 2024

Arizona State Tax Withholding 2024. All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax. Arizona annual payment withholding tax.

Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Arizona annual payment withholding tax.

Arizona’s Withholding Rates Are Unchanged For 2024 From.

For tax year 2022, there were two tax rates — 2.55% and 2.98% — that applied.

Arizona’s Income Tax For The Year 2023 (Filed By April 2024) Will Be A Flat Rate Of 2.5% For All Residents.

10.23% on bonus and stock options,.

Voluntary Withholding Request For Arizona Resident Employed Outside Of Arizona.

Images References :

Source: printableformsfree.com

Source: printableformsfree.com

Arizona Withholding Form 2023 Printable Forms Free Online, How to calculate 2024 arizona state income tax by using state income tax table. Arizona’s withholding rates are unchanged for 2024 from.

Source: printableformsfree.com

Source: printableformsfree.com

Arizona Tpt 1 Fillable Form Printable Forms Free Online, Tax rates range from 0.5% to 3.5%. The arizona state tax calculator (azs tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

Source: printableformsfree.com

Source: printableformsfree.com

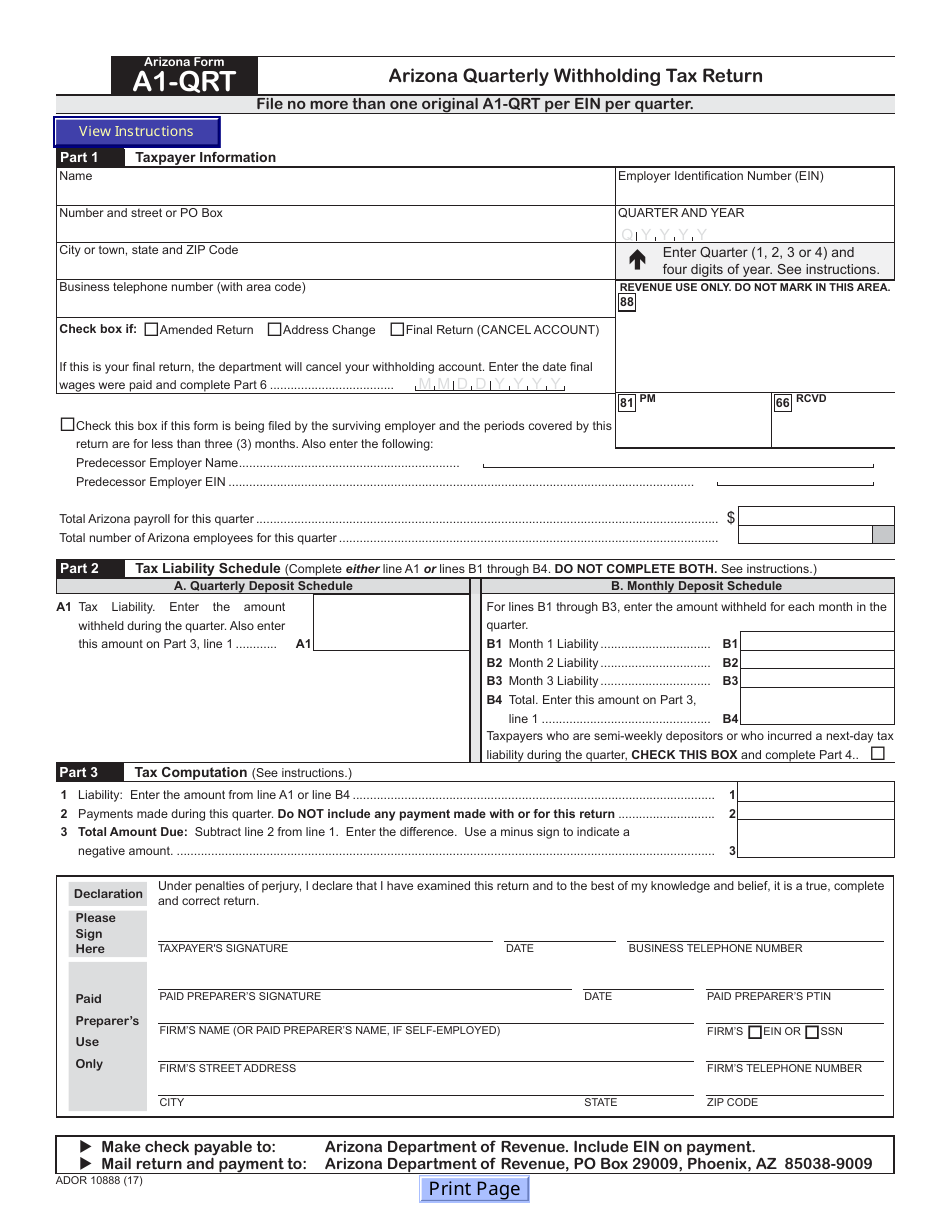

A1 Qrt Fillable Form Printable Forms Free Online, Arizona residents state income tax tables for head of household filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold; Find your pretax deductions, including 401k, flexible account.

Source: www.stockicons.info

Source: www.stockicons.info

96 best ideas for coloring Arizona State Tax, The arizona department of revenue jan. There are only 24 days left until tax day on april 16th!.

Source: www.vrogue.co

Source: www.vrogue.co

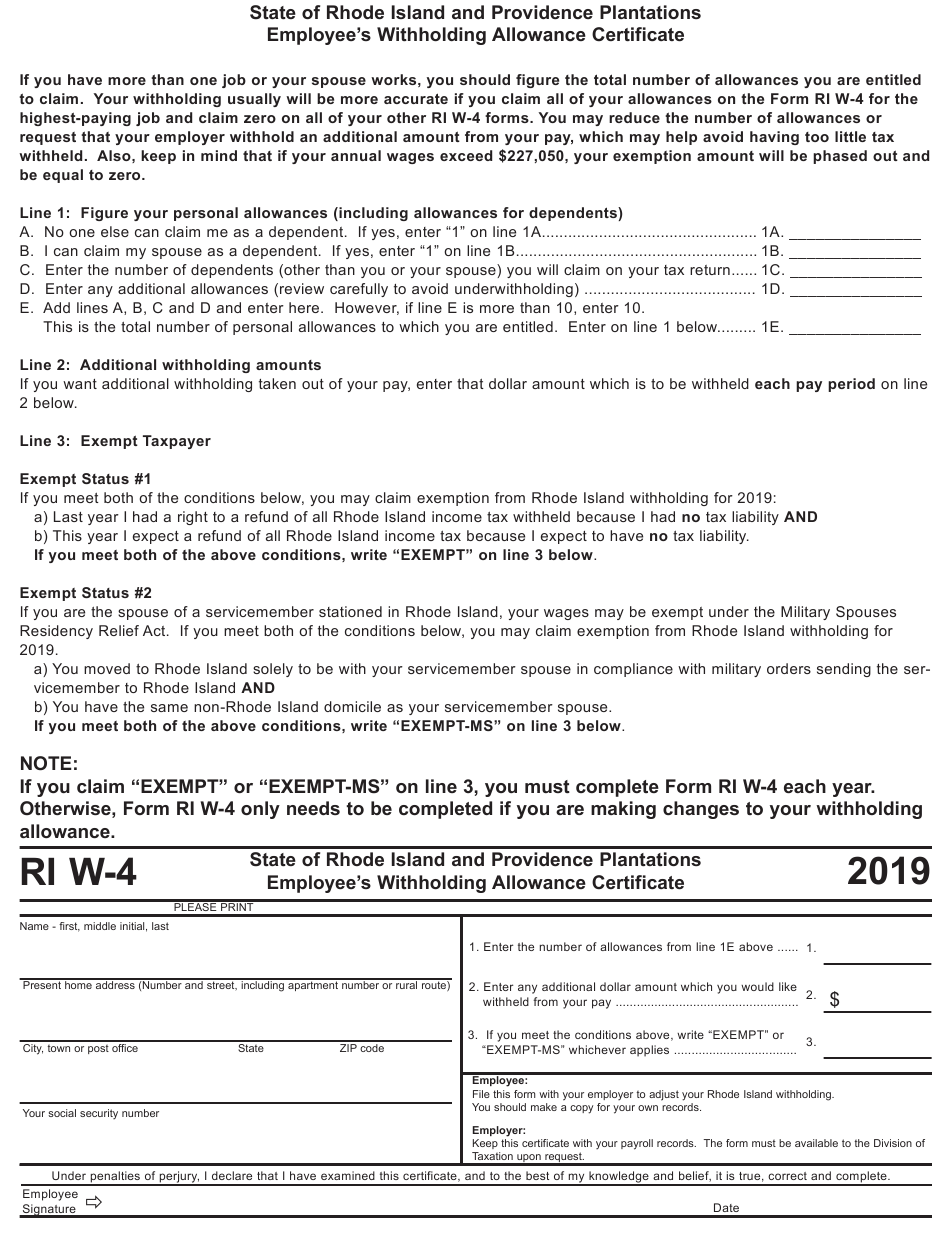

Employee Pa State Withholding Form 2023 Employeeform Net Vrogue, The arizona state tax calculator (azs tax calculator) uses the latest federal tax tables and state tax tables for 2024/25. How to calculate 2024 arizona state income tax by using state income tax table.

Source: mariebryanni.blogspot.com

Source: mariebryanni.blogspot.com

Tax withholding calculator 2020 MarieBryanni, Arizona annual payment withholding tax. Arizona’s combined state and average local tax rate of 8.37 percent is the 11th highest in the country, according to the tax foundation.

Source: www.printableform.net

Source: www.printableform.net

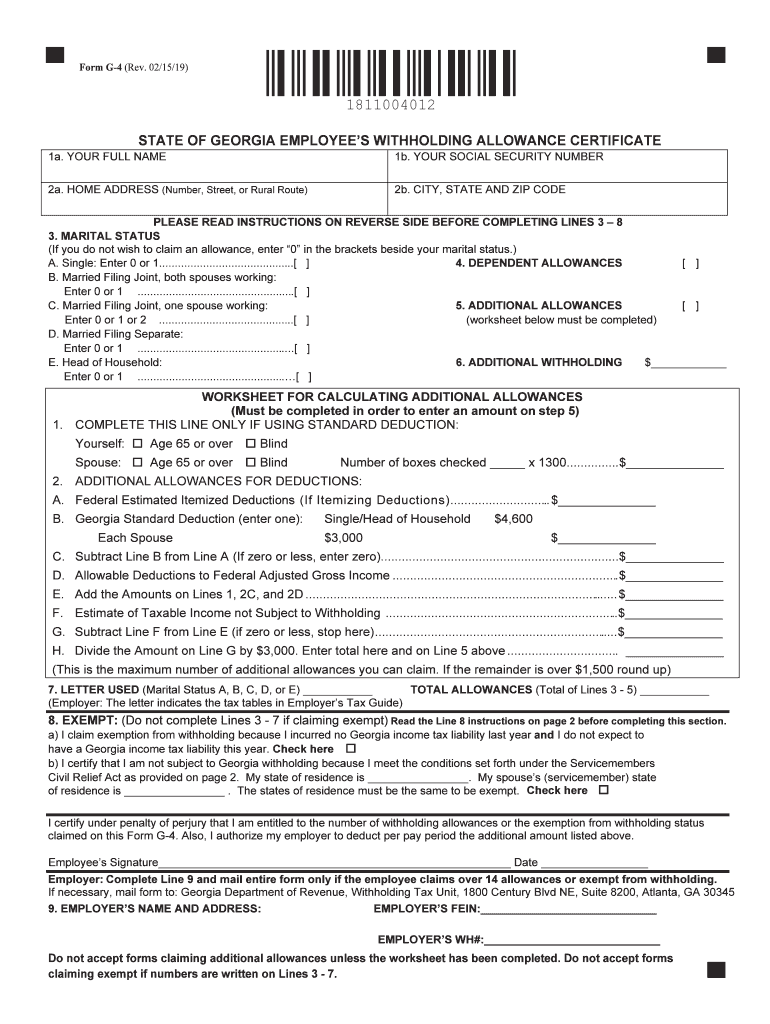

Printable State Of Tax Forms Printable Form 2024, Arizona residents state income tax tables for head of household filers in 2024 personal income tax rates and thresholds (annual) tax rate taxable income threshold; All wages, salaries, bonuses or other compensation paid for services performed in arizona are subject to state income tax.

Source: debeeqardelia.pages.dev

Source: debeeqardelia.pages.dev

Az Tax Brackets 2024 Arlena Olivia, Arizona’s withholding rates are unchanged for 2024 from. Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates:

Source: themarketatdelval.com

Source: themarketatdelval.com

State Of Arizona Withholding Calculator, For tax year 2022, there were two tax rates — 2.55% and 2.98% — that applied. 29, the dor will be.

Source: printableformsfree.com

Source: printableformsfree.com

Arizona State Tax Withholding Form 2023 Printable Forms Free Online, If you make $70,000 a year living in arizona you will be taxed $9,254. Arizona’s combined state and average local tax rate of 8.37 percent is the 11th highest in the country, according to the tax foundation.

Arizona Annual Payment Withholding Tax.

The arizona department of revenue jan.

Previously (And For The 2022 Tax Year), Arizonans Had To Pay One Of Two Tax Rates:

If you make $70,000 a year living in arizona you will be taxed $9,254.